Dec 2023 | Athera's Odyssey: Celebratory Edition 🥂

Raising a toast to Athera's 2023: People, progress and some bold bets!

In the third edition of Athera’s Odyssey, we are celebrating:

Athera’s 2023 Wrapped - the fulfilling culmination of some journeys, and exciting beginnings of many more; with a very special shoutout

Risk hai toh ishq hai, aur gains bhi - covering 23 gutsy moves in the ecosystem that defined the space they operated in

The Constellations of Success - applauding founders and their resilient triumphs

On-the-go Bites - interesting VC terms you should know

Athera’s 2023 Wrapped

In the VC business, hope springs eternal; and 2023 was a year in which we reaped the fruits of past hope, and sowed hope anew, in equal measure.

This was foremost a year of ‘building’. We readied ourselves for our $120M fourth fund (Athera IV) – continuing our sharp mission to back bold, tech-first founders solving hard problems at scale. We actively started raising earlier this year and hit the ‘first close’ by September; the pace made possible by a growing ecosystem of cherished well-wishers. We completed two investments from Fund-IV, with two more in the pipeline. In tandem with our largest-ever fund, we also added to the team. Rajiv joined us as a General Partner, Tanya joined us as our CFO, and Ishan and Kavya joined the investment team. With this set of additions, we grew the team not only in count but also in diversity – diversity of age, experience, gender, backgrounds, networks and thought processes. Each of us at Athera now has a unique background and voice, allowing us to be simultaneously inclusive as well as expansive in our thinking. Not surprisingly, we scored a record high on team outings, office banter, snacking, and oversharing. We’re proud to report that we have not recorded a single case of “Monday blues” this year - a metric we intend to hold at absolute zero.

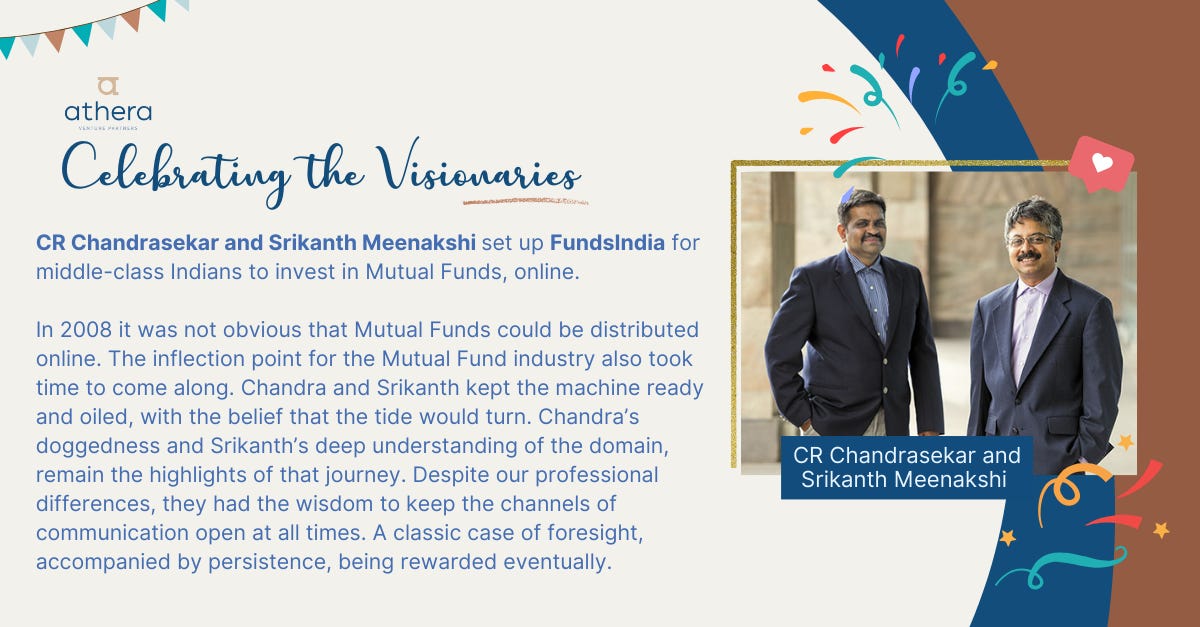

While we built, we also reaped - quite healthily, on our past bets. We recorded our highest quantum of exits in a single calendar year (an outcome we loved as VCs). At the same time, we remain more bullish than ever on the trajectories of our exited companies, even post our formal association (a situation we love as builders and believers). We exited PolicyBazaar, which continues to be a beacon in solving population-scale problems through tech. Savaari, built grounds up on ops excellence and customer obsession, found a new home in MakeMyTrip, much like redBus ten years ago. FundsIndia, an early FinTech pioneer solving a hard problem en-masse, found a new home as well, in Westbridge. CBazaar listed on the NSE Emerge (our second IPO), oversubscribed 511 times. When we first backed these visionary founders (and many others whose bull runs are unfolding at full steam), each of these businesses was far ahead of the curve in their respective domains. As we have in the past, we continue to seek such multi-year trends.

Exits aside, each live portfolio company hit it out of the park this year in the pursuit of excellence; no wonder, given the marathoners at the helm. Do reach out to us, should you wish to sample our - rational, not just impassioned - exuberance. Alternatively, head here for a quick peek, or browse the past editions of Athera’s Odyssey.

Amongst other matters: we staved off FOMO-driven decisions, continued to back resilient teams (with capital, time, resources, connections, patient ears, and open hearts), and found ourselves counting our blessings on multiple occasions – including encores of heartwarming founder-love, faith from our LPs, continued partnerships with our peers, and trust from decision makers. We continue to meet brilliant founders on a daily basis - many of whom have known us personally for years - and grapple with questions of selection, rather than sourcing. Such is the opportunity set for the India of 2024.

The year turned out to be more fulfilling and exciting than ever before. Athera’s growth flywheel is well in motion, backed by the momentum of past success and fresh energy alike. Not only does our hope spring eternal, but it also dares us towards new frontiers and farther horizons.

A Special Shoutout

“Risk hai toh ishq hai, aur gains bhi” 💰

Successful ventures are incomplete without interesting adventures - where the only safety net is a parachute made of conviction, resilience and determination. It's not just business; it's an odyssey, where often, fortune favours the brave.

Highlighting such interesting 23 bets by Indian ventures that further led to massive wins…

SAIF Partners (now Elevation Capital) rolled the dice with a gutsy move, putting $1 million into Vijay Shekhar Sharma's ambitious project, Paytm. They gave it a financial playground to test ideas for six months, and this bet evolved into one of India's biggest public offerings in 2021. Paytm's journey sailed from uncertainty to hyper-success amidst demonetisation and COVID-19. No one could have predicted the steep growth of UPI, and Paying Through Mobile in 2010.

Nithin decided to bootstrap Zerodha with his younger brother Nikhil in 2010, focusing on making it sustainable and profitable. With 3000 opened accounts in the first year to becoming a unicorn in 2020 - purely relying on bootstrapping was a journey of high customer focus and resilience. The team believed that “word-of-mouth” was the best marketing strategy and didn’t invest in marketing activities - and still don’t!

Adar Poonawalla, CEO of the Serum Institute of India, invested billions of dollars into his Indian vaccine production facility. It was a bold commitment to produce millions of doses of a yet-to-be-proven coronavirus vaccine. With impeccable leadership skills and resilience, his risky bets paid off - saving the lives of millions and more.

In 2010, Girish made a life-altering choice, bidding farewell to his secure job as VP of Product Management at Zoho Corp without a clear roadmap. He kickstarted Freshdesk with a small team of six, and over a decade, Freshworks was listed on NASDAQ and has become a celebrated behemoth we all know of!

Back in 2008, Athera took a huge bet by investing 5 crores on investing in redBus despite the Lehman Brothers crash. Solely because, the partners genuinely believed in the stellar team of Phani, Sudhakar, and Charan and their robust business model. Fast forward four years, redBus was sold with a significant ROI. Read more about Athera’s adventures with redBus here.

Earlier, food delivery apps only took orders and the restaurant had to deliver those to the customers. Swiggy was just doing 30 orders/day and took a risky bet by differentiating itself by focusing on logistics and owning the food delivery. When it succeeded, other players in the industry quickly replicated the template, algorithms, and playbook. This led to cementing a strong foothold and redefining the food delivery landscape in India.

In 2013, the founders wanted to create a broker-free C2C marketplace to disrupt the property tech scenes in India - and it was a bold bet to automate the process against conventional brokers. 99acres, Housing.com backed by SoftBank, and MagicBricks were making waves, but they hadn't eliminated the need for brokers. Cut to a decade later, NoBroker is the first proptech unicorn in India.

Athera invested in PolicyBazaar in March 2013 despite a founder’s exit, their ongoing transition from leads to transactions business model and considerable regulatory overhead. It took high advertising budgets to create a major mindset shift from traditional door-to-door insurance sales to buying from an online platform alongside 10+ competitors. Know more about Athera and PolicyBazaar’s partnership here.

Anupam Mittal founded Shaadi.com in 1997 when internet usage in India was still in its infancy and online matchmaking virtually was unheard of. The primary risk was cultural, as arranged marriages were traditionally facilitated by families and not through an online platform. The stakes were high, as failure could have resulted in social backlash and financial loss, as matchmaking is a sensitive societal topic.

Fogg (Vini Cosmetics)

When Axe (deodorants) had a monopoly, Fogg (an acronym for ‘Friend of Good Guys/Girls’) positioned itself as a long-lasting deodorant with a simple but thought-through marketing campaign - “Kya chal raha hai?” "Fogg chal raha hai" (Fogg is working) - contrary to the popular “sex appeal” advertising used by deodorants. In just 3 years, Fogg was leading the market share and soon, Axe left and became a franchised brand in India.

Offering a one-stop solution, a digital yellow page - at one’s fingertips for various household services, including plumbing, electrical work, beauty services, and more - was an ambitious vision in 2014. The biggest challenge was to gain the trust of the Indian consumers to let people in their house - sourced from an app, along with high QC and operational challenges. To solve this, they built a full-stack, fulfilment model. And today UC operates in 61 cities across 4 countries.

Dr Charit, an interventional cardiologist, founded Tricog in 2014 as he wanted to save lives at scale by identifying people at cardiac risk quickly for further treatment. Tricog pioneered the integration of AI into the healthcare industry, way before it was called AI. Athera believed in the passion and partnered with them in their journey. Today, Tricog has helped 15 Million patients worldwide. Read the full story here.

Ghazal Alagh co-founded Mamaearth, a toxin-free baby and adult care products brand with the risk of entering a market dominated by established FMCG giants with a focus on a niche segment. The stakes were high as failure could have meant losing credibility in a sensitive market like baby care products. Shilpa Shetty took a bet as an early investor and Mamaearth rang the bell at NSE last month.

Flipkart’s acquisition of PhonePe in 2016 at $20 Mn, without PhonePe having a substantial product was a bold move. They bought back shares of $700 Mn in Dec 2022 - as PhonePe decided to be a separate entity. Today PhonePe is leading the market and is valued at $12 Billion, making this acquisition one of the smartest decisions in the Indian startup ecosystem.

After a modest Series A, followed by rapid growth, and a subsequent Series B in 18 months, the company encountered tough competition from deep-pocketed rivals. CEO Gaurav took a calculated risk by taking a strategic step to secure more funding from Athera and refocused Savaari on the profitable inter-city road travel sector. It further led to MakeMyTrip acquiring Savaari a few weeks ago.

Inspired by the day-to-day hassle of managing APIs via rudimentary tooling, Abhinav took a bet and built a Chrome extension to make his life easier. Soon, it became more than a side project as Postman was solving a worldwide problem. The firm was established in late 2014 and in under six years, managed to break into the exclusive league of unicorns, along with a $5.6B developer community.

Deep and his friends started MMT in 2000 to make travel planning easy and simple. The dot-com meltdown, the exit of VC firms from India, and the aftermath of the 9/11 attacks created hurdles, and by mid-2001, MakeMyTrip was hit by this triple whammy. The following years proved to be incredibly demanding—had to downsize the team, and there were no investors in sight. They made their trip through continents and MMT was listed on NASDAQ in 2010.

BigBasket was founded in 2011, by dot-com bust survivors. The freshness of groceries can’t be determined digitally and getting early adopters was a daunting challenge, and then retaining them too. They gradually built trust - and shaped buying behaviour. Today, BB is India’s largest online grocer and was acquired by Tata Group with a 64% stake in 2021.

In 2012, at the age of 50, Falguni had a vision to build an online beauty marketplace - when e-commerce wasn’t even popular. Her perseverance and continuous investments in marketing paid off and Nykaa soon launched its beauty products. Nykaa experienced hockey stick growth since 2018 and was listed in 2021 at NSE.

Athera’s portfolio company, Pixxel was founded by Awais and Kshitij while still studying at BITS Pilani in 2019. They dived straight into space tech with an audacious goal of solving seen and unseen on-ground problems in climate change, agriculture, and more using hyperspectral satellite imagery. From overcoming regulatory hurdles to building satellites for the Indian Air Force to collaborating with SpaceX, the young duo is truly shooting for the stars!

Khadim & Vara started off with ‘SearchEnabler’ in 2014 - an on-demand SEO platform, which further morphed into Whatfix and solved for B2B SaaS. Digital adoption was a fairly alien term back then. Gartner has officially acknowledged the emergence of the 'Digital Adoption Platform (DAP)' category, designating Whatfix as a pioneer in this field, followed by Deloitte and Everest Consulting. Whatfix is a dapper unicorn in the pipeline.

Dream11 kickstarted in 2007 as an ad-supported business model with a season-long structure, but it never gained traction. They pivoted to daily matches and allowed users to wager on the teams. Dream11 started offering its first freemium service in 2012 and overcame legal hurdles. Kalaari invested in 2014 and propelled their dream forward. It entered the unicorn club in April 2019 - as the first Indian fantasy sport company.

Sula, a pioneer, innovator and leader in the Indian wine industry today was started on grasslands full of snakes and leopards in Nashik in 1999 - that too, in a country like India where the market is grossly dominated by traditional alcoholic beverages. Year after year, Sula’s impressive winexperience further led to diversifying its portfolio. Sula said cheers to the NSE bell in December 2022.

The Constellations of Success ✨

On-the-Go Bites 🥨

Zombie Fund - Ever met that fund that just won't call it quits? And is still wandering the financial streets, not quite alive, not quite dead—just looking for a decent exit strategy.

Vulture Capitalist - The cool kids of finance, turning distressed companies into financial feasts

Cockroach Startup - The persistent, adaptable, and seemingly indestructible, surviving everything the business world throws at it

Hockey Stick Growth - That magical moment when things take off - Imagine a hockey stick, and then imagine the profits going through the roof

FOMO Funding - It is like the Black Friday of investments. Jump in now, or forever regret missing out on the party!

Ninja Exit - is the startup world's disappearing act. Quick, quiet, and leaving everyone in awe.

May your startups soar, your due diligence be swift, and your cap tables be nothing short of legendary!

Wishing you all a fabulous holiday season and an adventurous 2024!